CFO Message

Aiming to achieve the targets set in FSG.30, our new management plan, by making prompt investments essential for growth

Director,

Executive Officer in Charge of Finance, CFO

Akikazu Yada

Looking back on FY2023

We initially anticipated a recovery in demand by FY2023. However, the reality was different: global inflation rose, weakening consumer demand and putting our industry in a challenging position. While material costs decreased in Europe and the Americas, they continued to rise in Japan. Additionally, rising interest rates in Europe and the Americas further impacted our business. Navigating the Group through these challenges required difficult decisions on securing funds and reducing interest expenses. It was an ever-changing particularly challenging financial situation.

Recovery in the Operating Profit Margin and Return on Equity (ROE)

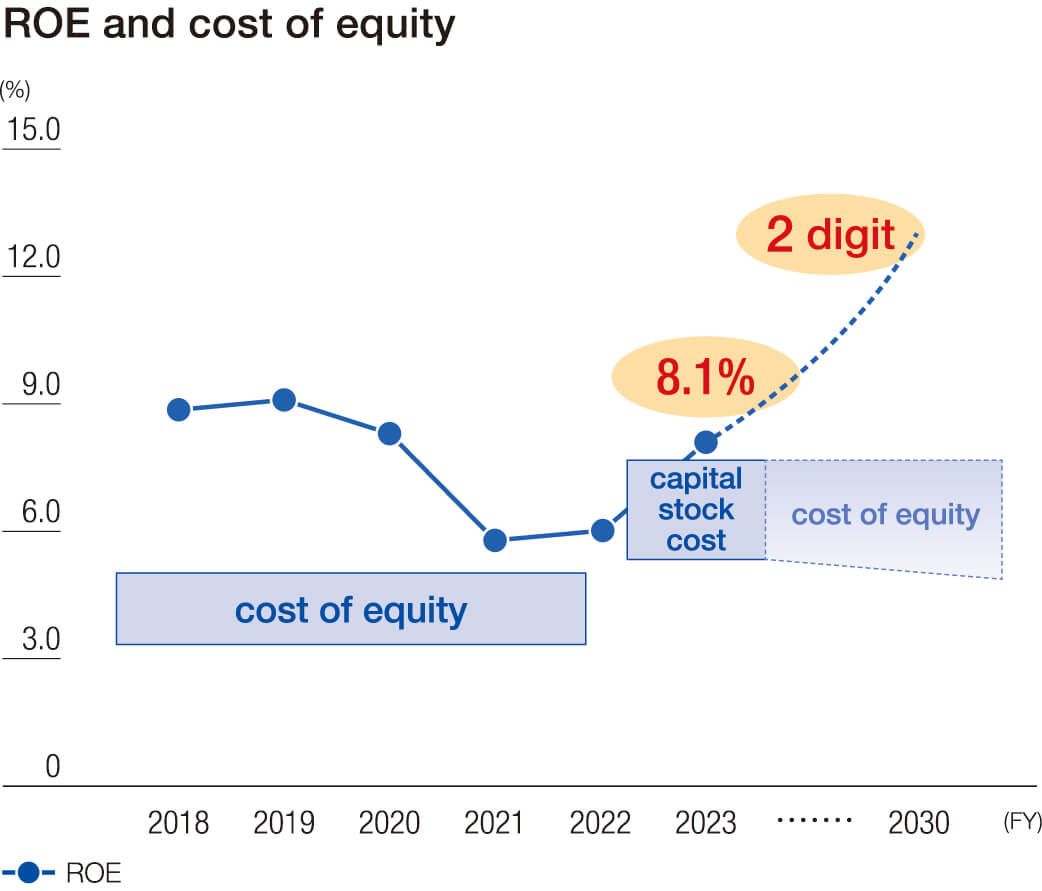

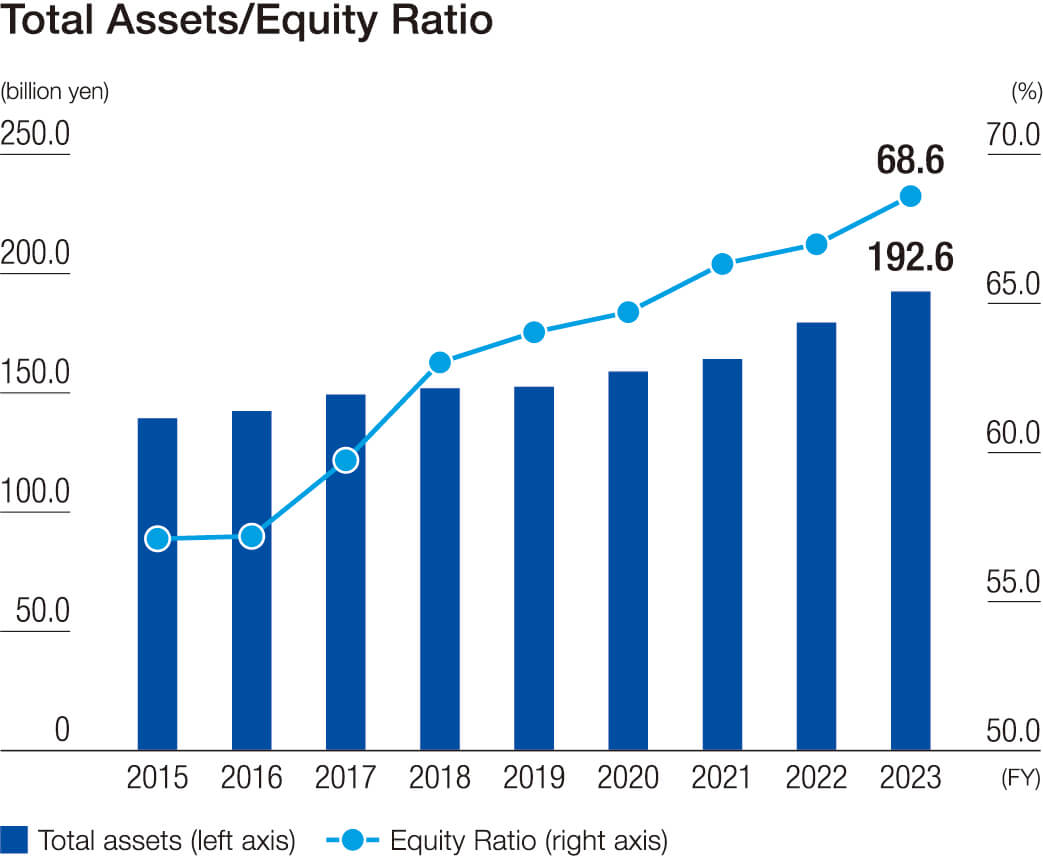

For FY2023, we achieved an operating profit margin of 6.8%, exceeding 4.5% in FY2022 and 6.2% in FY2021. Return on equity (ROE) was 6.0% in FY2022 and 5.8% in FY2021, and it recovered to 8.1% in FY2023. We hope to ensure that ROE will reach 9.1%, the peak it hit in FY2019, as soon as possible. Moreover, cash flows from operating activities reached an all-time high, and free cash flows turned from negative to positive. The equity ratio remains healthy at 68.6%.

These results are primarily due to the recovery of our core business worldwide. However, in FY2023, we established specific regional reduction targets and implemented improvement measures for all components of the cash conversion cycle (CCC)-purchasing, inventory management, and accounts receivable. We were deeply committed to achieving these goals, and we believe this commitment significantly impacted our business results.

FSG.30, a new management plan that outlines the strategic direction FSG aims to pursue

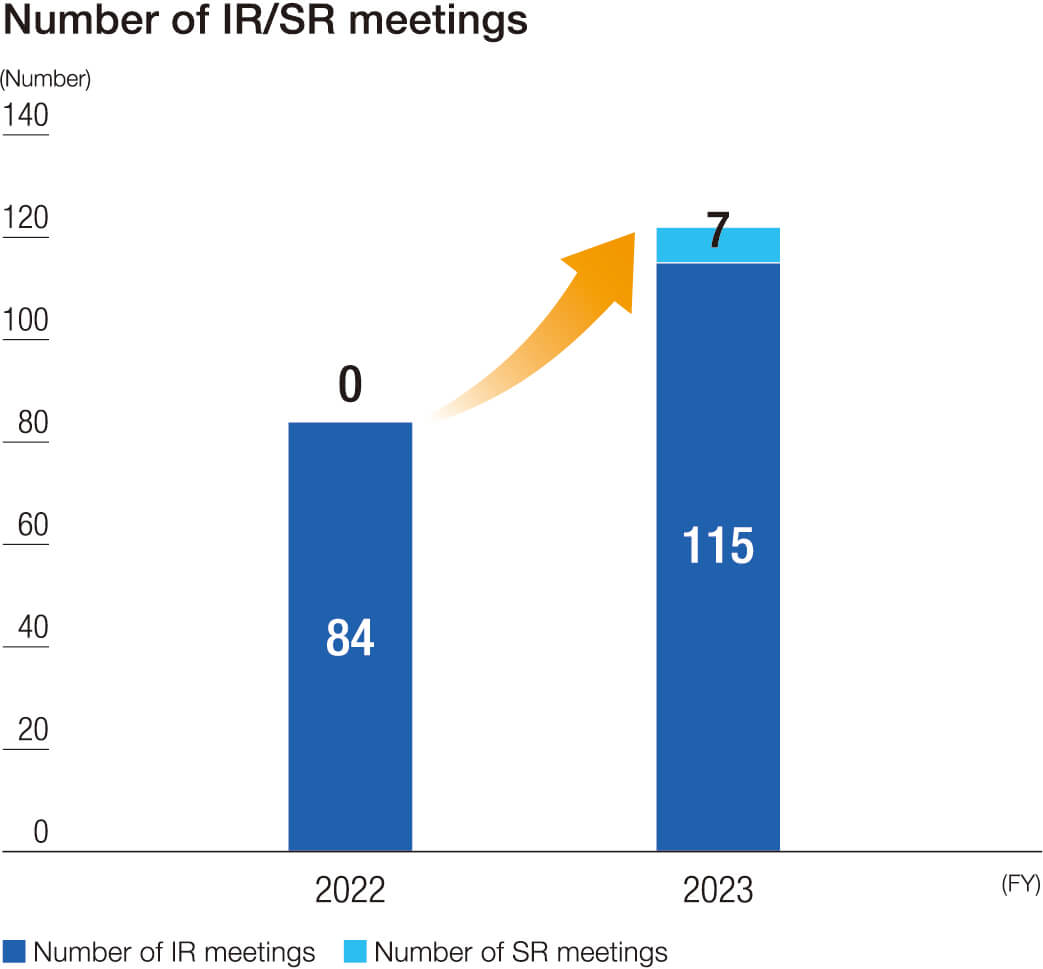

In FY2023, we increased our opportunities to have dialogues with investors, receiving valuable feedback from a wide range of stakeholders both in Japan and overseas. We are truly grateful to them for taking the time out of their busy schedules to meet with us. Many investors expressed a desire for FSG to more clearly communicate its strengths, business foundation, and growth strategies, which had not been effectively conveyed. In response, in FY2024, we will strive to articulate more clearly our direction, the challenges we face, and the areas we will enhance, ensuring our aspirations are better understood.

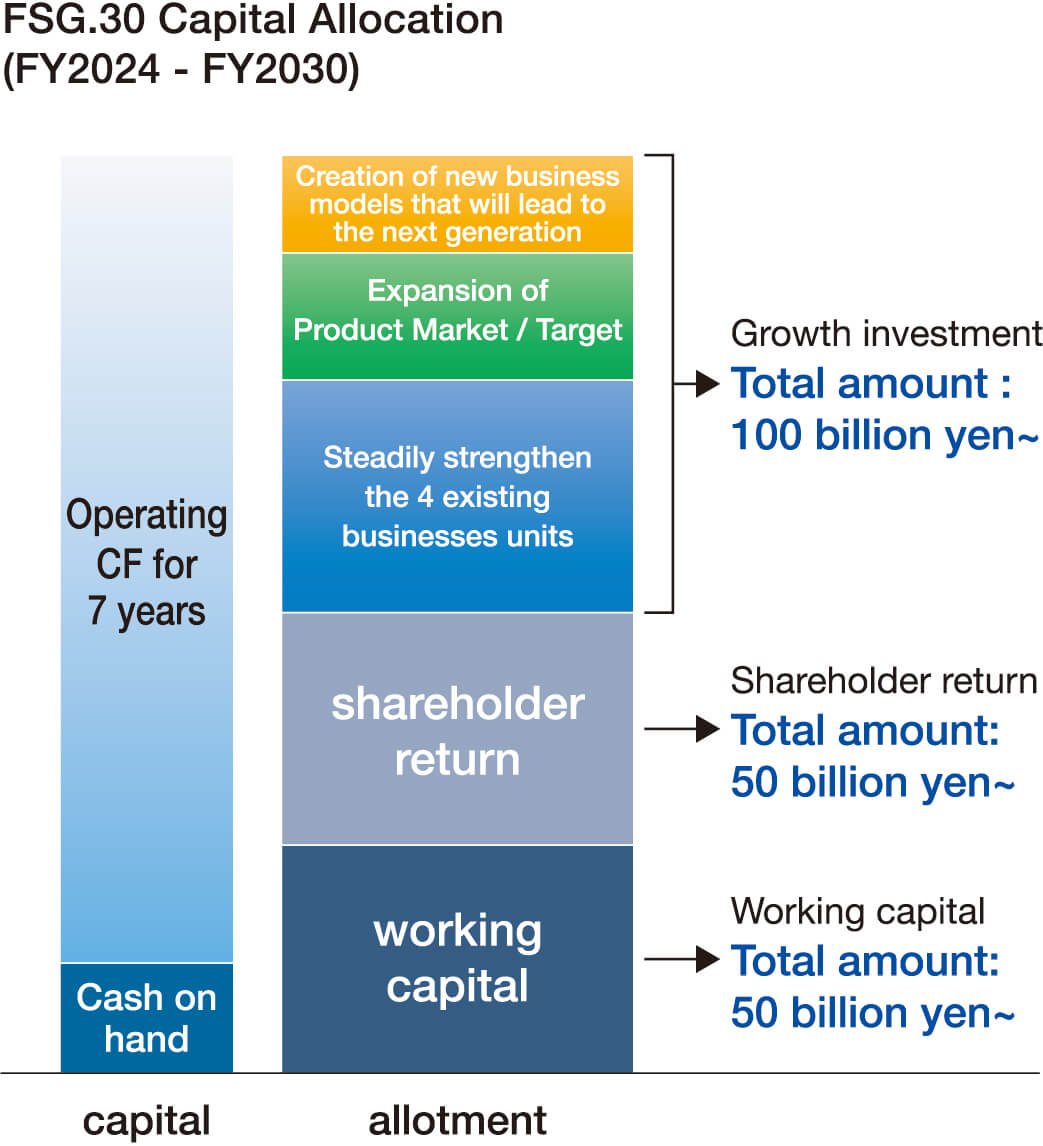

The new management plan FSG.30, shows the direction that FSG should take in capital allocation for FY2024 to FY2030. In order to make the most effective use of these resources, as a first step, the plan envisions that FSG will use the sum of deposits on hand as of the end of FY2023 and cash flows from operating activities over the past seven years as funds. Toward the most effective use of these resources, we have decided to invest 100 billion yen or more in pursuit of the three strategies of creating new business models that will lead to the next generation, expanding product markets/targets, and steadily strengthening the four existing business units.

This was our initial attempt at disclosing capital allocation, but investors have shown their interest in it and have been engaged in lively dialogue with us. We also believe that our attempt to show the targets to FSG employees has enabled us to clarify the direction the Group should take.

Revisions to our dividend policy and cost of equity

Our former financial policies were somewhat conservative in terms of growth investments and shareholder returns while placing us on a solid financial footing. To achieve the KPI targets set toward the accomplishment of FSG.30, we will adopt a completely new financial approach and shift to active growth investments and shareholder returns.

We recognize that we need to further increase our corporate value in the future and that we are now at a turning point in our policy. Therefore, we revised our dividend policy in the second half of FY2023. The revisions are as follows: 1) we will invest in sustainable growth (technology development, human resource development, capital investment, M & A); 2) we will aim to achieve a target consolidated dividend payout ratio of 30%, in principle, and to steadily and constantly increase dividends per share while taking into comprehensive consideration the level of our Dividend on equity (DOE), changes in the business environment, etc.; and 3) we will build a stable financial foundation in preparation for emergencies and flexibly acquire and dispose of treasury stock. Compared to our previous policies, these revised policies are more aggressive and clearer, especially regarding shareholder returns.

We also reviewed our cost of equity. Previously, we had calculated the cost of equity capital by closely following our own capital asset pricing model (CAPM) of calculation and had estimated it to be around 5%. However, we realized that investors might expect to receive more returns than anticipated and that it would be more appropriate to consider multiple indicators, rather than limiting ourselves to one, in our use of the CAPM. After taking into consideration the opinions of securities companies, analysts, and investors, we have recently revised the figure for our cost of equity capital to 6-8%.

As a result of this review of the weighted average cost of capital (WACC), which provides the basis for calculating the cost of equity capital, has also increased by 1 to 3 points. Consequently, the hurdle rates have also increased by 1 to 3 points compared to the previous level. This means that some projects will not be approved as investment targets under the revised guidelines even if they would have been previously. In other words, as a result of the increase in the hurdle rates, larger investment projects planned toward the accomplishment of FSG.30 will be required to achieve higher profit margins. It can be said that we now have a mechanism in place to automatically improve ROE.

Three initiatives to achieve ROE targets

FSG.30 sets an ambitious target of achieving a double-digit ROE that sufficiently exceeds the cost of equity. The most recent ROE is 8.1%, so we believe we can achieve this by 2030. However, it is still a challenging target and one that cannot be achieved by following the same old path. Therefore, the finance department has devised three specific initiatives: 1) expanding future profits, 2) improving capital efficiency, and 3) pursuing an optimal capital structure.

Expanding future profits, initiative (1), is concerned with the abovementioned capital allocation envisioned in FSG.30, which is an effort to increase both future profits and profit margins by optimizing resource allocation and expanding growth through active investment.

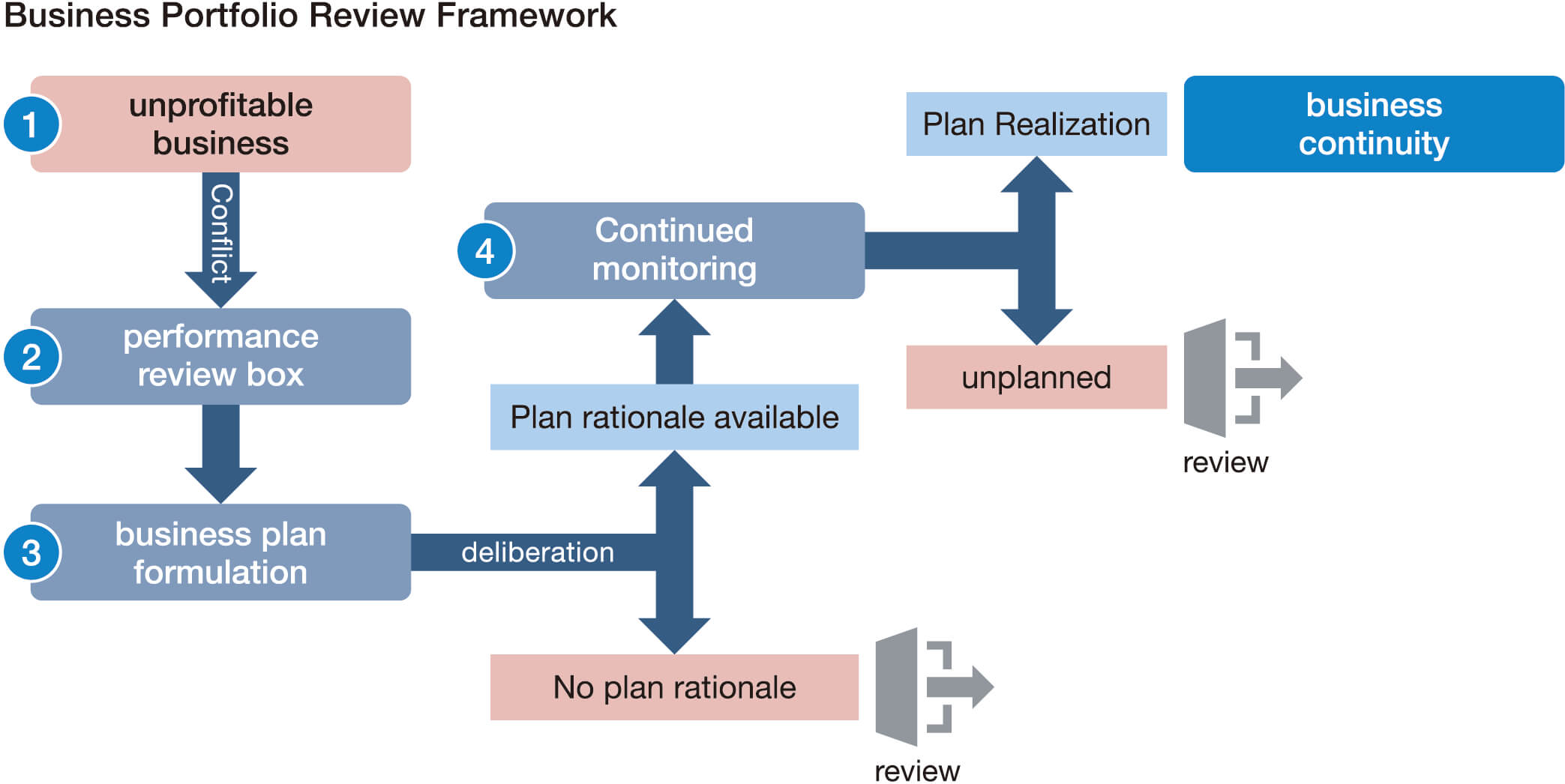

Improving capital efficiency, initiative (2), will mainly involve reviewing our business portfolio. By reducing unprofitable businesses and assets, we will ultimately improve capital efficiency. Needless to say, we had been reviewing our business portfolio before, but due to a decline in profitability triggered by rising raw material prices during the COVID-19 pandemic, unprofitable businesses peaked in 2022, so we went back to the basics and rebuilt our framework. Unprofitable businesses are now placed in a performance review box, separately placed and managed from other businesses. The head of each of those businesses develops a business plan to achieve a recovery in performance. As a first stage, the Board of Directors will determine the rationality of that business plan and whether or not that business should be continued. We have established a system in which, even if the Board of Directors determines that an unprofitable business should be continued, it will remain within the performance review box during the period of the business plan, and the Board of Directors will periodically monitor the progress of the plan. If there are any significant deviations from the business plan, a second-stage decision will be made on whether or not the business should be continued. In FY2023, we used this framework and compensated for the deterioration in profit margins due to rising raw material costs with price revisions, thereby significantly reducing unprofitable businesses. In FY2024, we will continue to strictly apply this framework to remaining unprofitable businesses, aiming to further reduce the number of unprofitable businesses.

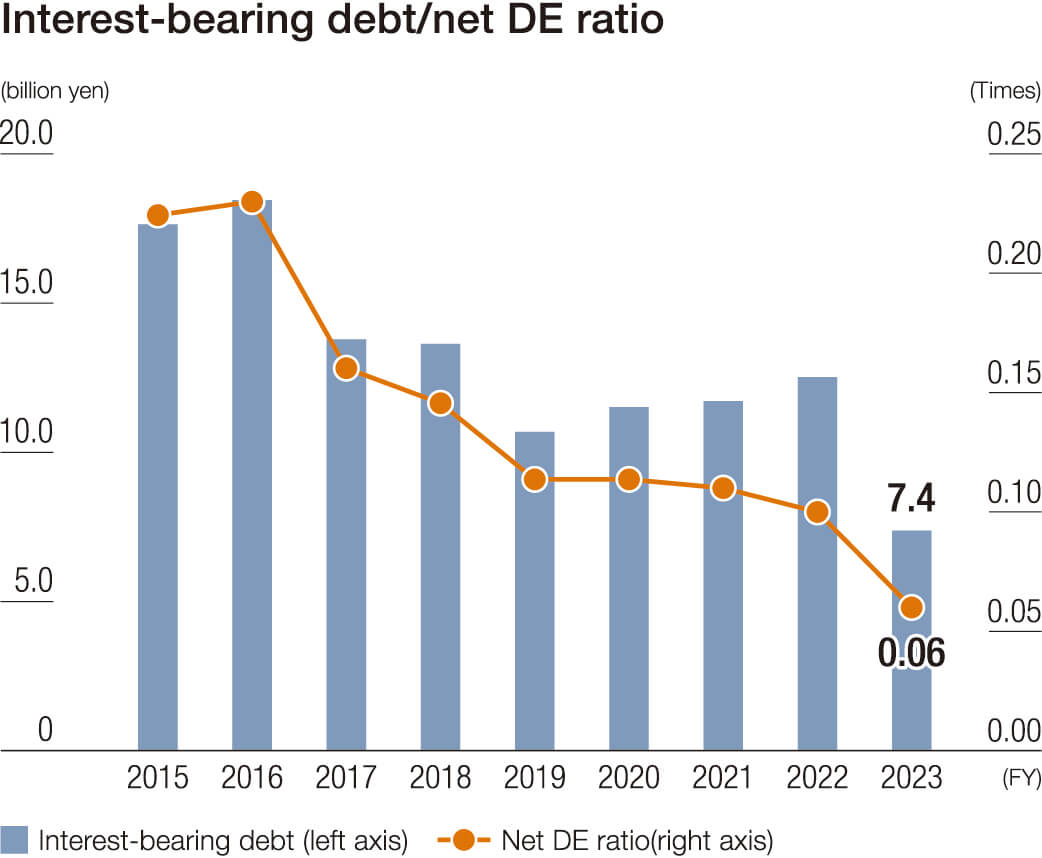

Initiatives (1) and (2) above focus on improving net income, which is the numerator in the ROE formula, while initiative (3), pursuing an optimal capital structure, is an initiative focused on reducing equity capital, which is the denominator in ROE. As shown in the graph on the next page, the equity ratio has been rising each year due to the accumulation of net income, while the net debt-to-equity ratio has been declining. This means that equity capital, which is the denominator of ROE, is swelling, and no matter how much profitability is improved, an increase in ROE will be limited. Therefore, as a measure to reduce equity capital, we have revised our dividend policy as mentioned above to pay dividends more actively. In addition, as envisioned in FSG.30, we will flexibly acquire treasury stock with an eye to the future to further reduce equity capital. In this way, we will address both the numerator and denominator and accelerate the improvement of ROE.

By rigorously and steadily implementing the above initiatives (1) to (3) through 2030 under the leadership of the finance department, we will ensure the realization of a double-digit ROE.

Deepening shareholders' understanding through detailed dialogue

The stock price, which had been sluggish in the first half of FY2023, recovered after the Company was able to revise its earnings forecast upward in the third quarter. However, it is still not at a satisfactory level for our shareholders and investors. We aim to achieve a further increase in our share price by achieving a further recovery in our business performance, clearly explaining and executing our growth strategies while at the same time steadily and constantly increasing dividends. As of June, the price-to-book ratio (PBR) was just under 1, recovering slightly as the stock price has recovered. However, given that it was 2.0 in the past, meeting the expectations of our shareholders naturally requires us to achieve the target of 1.5 or more set in FSG.30. We believe that the key to achieving this is to clarify our equity story, that is, our strategies for recovery and growth.

We hold approximately 80 investor relations (IR) interviews per year to discuss our performance and growth strategies. In FY2023, we added to them shareholder relations (SR) interviews to discuss sustainability and other issues, ending up with more than 100 interviews in total. In FY2024, we will continue to proactively hold IR and SR interviews to provide our shareholders and investors with detailed explanations of our medium- to long-term sustainability initiatives, as well as our corporate governance and efforts to increase corporate value. Through this kind of detailed dialogue, we hope to deepen their understanding of the Fuji Seal Group and to listen carefully to their requests.