Governance

Corporate Governance

Corporate Governance System

FSG transitioned to a “Company with a Nominating Committee, etc.” (then called “Company with Committees”) as early as 21 years ago in June 2004. This company structure, based on the so-called monitoring model, was introduced following revisions to the Commercial Code that took effect in April 2003. It is considered an institutional design with high management transparency, in which supervision of management and execution of business are separate. As of May 2, 2025, only 97 of the listed companies in Japan had adopted this system.

The Nominating Committee considers and makes decisions on the appointment and dismissal of director and executive officer candidates in light of the standards for appointment with the aim of contributing to the establishment of appropriate management systems for the Group. This committee also deliberates and submits proposals on the nomination of officers of FSG companies from the perspectives of enhancing Group management and developing next-generation human resources.

To ensure transparency in Group management, the Remuneration Committee deliberates and decides on the remuneration of not only FSI directors and executive officers but also officers of other FSG companies, in accordance with the Basic Policy on Remunerations and other matters, from the perspectives of enhancing Group management and developing next-generation human resources. To ensure that remunerations serve as a strong motivator for achieving FSG.30, we reviewed the remuneration system in FY2024 to improve fairness and transparency, deliberated and examined the incentive effects of remuneration, and revised the system and levels of remuneration.

The Nominating Committee and Remuneration Committee, both chaired by CEO Shigeko Okazaki, are composed of four members each: one inside director and three outside directors.

The Audit Committee has been established to secure legitimate, appropriate and efficient operations of the Group, which means operations based on the annual policy and medium- to long-term management policy. The Audit Committee is composed of three outside directors.

Structure of the Board of Directors

The Board of Directors consists of six directors, including three independent outside directors (as of the close of the General Meeting of Shareholders held in June 2023). Diversity of the members is also taken into consideration. The inside directors are highly experienced in different fields: overall corporate management, including management strategies, managing a business company of the Group, and operating overseas businesses.

Each of the three outside directors has extensive knowledge as a lawyer, certified public accountant, safety, disaster prevention and manufacturing manager, mainly in the technology development area, and a senior executive of a publicly traded company. One of the six directors is a woman. Although all of the directors are Japanese nationals, they have extensive knowledge, experience and capabilities in a broad range of areas, including overseas business experience.

In FY2025, the Company reduced the maximum number of directors specified in Article 17 ("Number of Directors") of its Articles of Incorporation from 15 to 10 in order to align with its current business development and scale. We will strengthen the Group's corporate governance by constantly reviewing our governance system.

Assessment of board effectiveness

All FSI directors respond to an annual questionnaire survey regarding the self-assessment of the Board of Directors' effectiveness. The board then deliberates on the survey results and issues to be addressed.

The surveys and deliberations conducted in April 2023 and April 2024 referred to the Japanese Ministry of Economy, Trade and Industry's Guidance for Collaborative Value Creation 2.0, which was revised in August 2022, and focused on eight items of guidance regarding governance given in the Guidance. The opinions of the board members on the assessment of the board's current status and issues to be addressed were summarized. Specifically, the board reflected on its efforts and assessment of each of the following items and identified and discussed the issues to be addressed: (1) Division of roles and functions between the board of directors and top management, (2) Ensuring the strength of the board, (3) Skills and diversity of CEOs and top management, (4) Skills and diversity of outside directors, (5) Monitoring strategic decisions, (6) Shareholder return and reinvestment policies, (7) Compensation policies, and (8) Reviewing board effectiveness and identifying priority items.

In FY2024, the board did not conduct a questionnaire survey on the directors' self-assessment of effectiveness. Instead, board members engaged in specific individual improvement activities for their individual issues based on the results of the previous self-assessment.

Remuneration of directors and executive officers

FSI has established the Remuneration Committee to ensure management transparency of the Group.

To maintain transparency and independence, the Remuneration Committee consists of four members: three outside directors and one inside director.

The Remuneration Committee is responsible for the following: establishing the policy for determining the individual remuneration of directors and executive officers; setting their specific remuneration; and determining the assessment of company-wide performance targets related to the determination of performance-linked remuneration of executive officers and individual performance targets for each executive officer.

The Remuneration Committee has established the following policy for setting the specific individual remuneration received by directors and executive officers.

- (a) Basic policy on remunerations

The remuneration of the Company's directors and executive officers should encourage them to perform their duties in line with the Group's slogan and serve as a strong motivator for achieving the Group's vision and the management plan FSG.30 to increase corporate value sustainably in line with the Group's corporate philosophy.

- 1)The remuneration system must enable and reward diverse and talented human resources in agreement with FSG's corporate philosophy.

- 2)The remuneration system must encourage the achievement of performance targets based on the management strategy for sustainable growth.

- 3)The remuneration system must encourage the sustainable enhancement of corporate value and share profits with shareholders.

- 4)The decision-making process for the remuneration system should be objective and transparent.

- (b) Overview of the remuneration system

-

- 1)Procedures

- The remuneration policy, remuneration system, and performance-linked system for directors and executive officers are deliberated and decided by the Remuneration Committee, which consists of a majority of outside directors.

- 2)Composition of remuneration

- Directors, including outside directors, receive only base remuneration as fixed remuneration, while executive officers receive base remuneration and variable remuneration consisting of performance-linked remuneration as a short-term incentive and restricted stock remuneration as a medium- to long-term incentive.

- 3)Base remuneration

- The base remuneration of executive officers is individually determined through deliberation by the Remuneration Committee in consideration of the job description, importance of job responsibilities, and career history of each executive officer, as well as the Company's dividend performance and business environment.

- 4)Performance-linked remuneration

- Performance-linked remuneration is aimed at serving as a short-term incentive for the achievement of management plans and is provided to encourage each executive officer to demonstrate their diverse abilities. It is paid at an appropriate percentage set by the Remuneration Committee based on the degree of achievement of the targets to be achieved in a single fiscal year. This remuneration varies from around 0% to 30% of the total remuneration. Calculation items include consolidated sales and operating profit margin for a single fiscal year, financial indicators important in terms of management strategies, and non-financial indicators such as environmental and human resource development indicators.

- 5)Restricted stock remuneration

- Restricted stock remuneration is paid to executive officers as an incentive to align their economic interests with those of the shareholders and increase the Group's corporate value in the medium to long term. It is granted at a fixed time each year, with the number of shares granted determined through deliberation by the Remuneration Committee based on each executive officer's job description and importance of job responsibilities, as well as the stock price level and other factors.

Risk Management

FSG has established the Group Risk Management Rules, which define its basic policy and management systems to address the various risks that may arise in the course of business. The Group Risk Management Rules not only provide for a disaster prevention system and a crime prevention and security system but also define the organizational structures and roles of the Group Risk Response Headquarter and the Regional Risk Response Headquarter as crisis management bodies in the event of an emergency, accident, or incident.

Risk management in ordinary times

In ordinary times, FSG's basic framework for risk management requires that potential risks be periodically identified and located on (regional and Group-wide) risk maps according to their level of impact on management and likelihood of realization and that systems be established to address those risks, based on the risk maps. Each year, we use risk maps to share risk awareness and constantly consider responses to these risk events (avoidance, transfer, reduction, acceptance, etc.) and implement action plans in order to improve the Group's risk responsiveness.

Risk management in times of emergency

On the other hand, in the event of an emergency (when an incident occurs), a Group Risk Response Headquarter will be established at the regional and Group levels, as needed, to ensure a swift and appropriate response across the Group.

FSG has established a Group-wide emergency contact network to ensure that in the unlikely event of a risk event or incident, it is reported to management as quickly as possible depending on the impact and importance of the risk. Business chats are currently used as the form of communication. This enables us to quickly share information and risk awareness and respond and provide instructions swiftly, regardless of where incidents occur within the Group - both domestically and internationally - and regardless of where the management team members are located.

Compliance

Fuji Seal Group (FSG) Code of Ethics

As a global firm, FSG has established and published the FSG Code of Ethics, positioning compliance, which is a prerequisite for business activities, as the most important management issue. The FSG Code of Ethics defines the universal values to be observed and followed by each director, executive officer, senior management member, and employee of FSG (hereinafter, "FSG Personnel") from a corporate ethics perspective as Ethical Standards and establishes a Code of Conduct to sincerely implement them.

Group-wide compliance management system

FSI has in place the Group Compliance Committee to promote and support compliance management throughout the Group.

The Group Compliance Committee submits reports and deliberation requests on important issues related to compliance to the Board of Directors. The duties under the responsibility of this committee include devising and deciding on organizations and systems related to compliance; deliberating on the revision and abolishment of provisions in the FSG Code of Ethics; developing and finalizing compliance-related action plans for FSG as a whole; and monitoring the implementation of those action plans. Specifically, the committee establishes a Group Compliance Slogan and deliberates on and considers annual topics and initiatives while monitoring compliance-related issues.

Each region has also established a Compliance Committee to promote compliance management within the region.

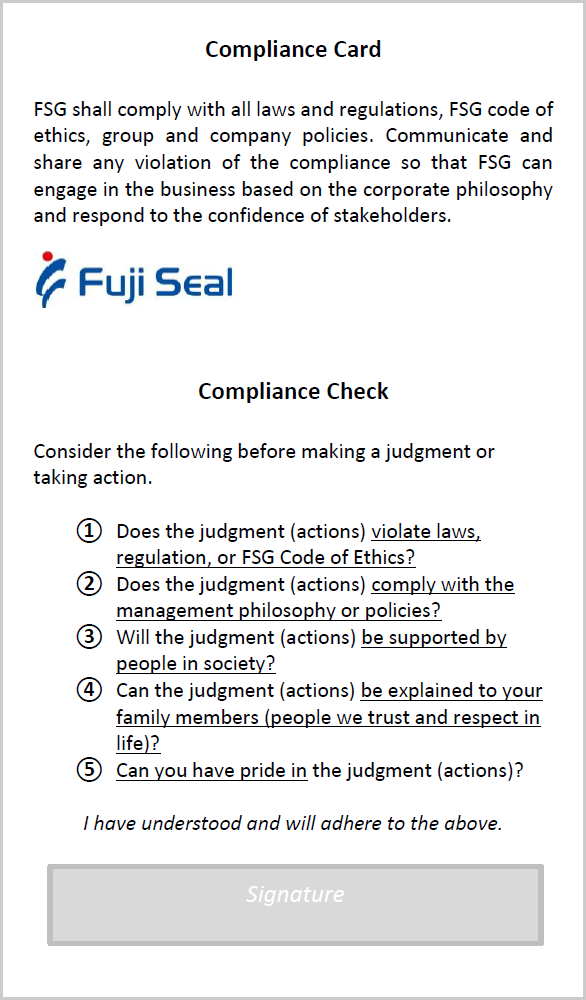

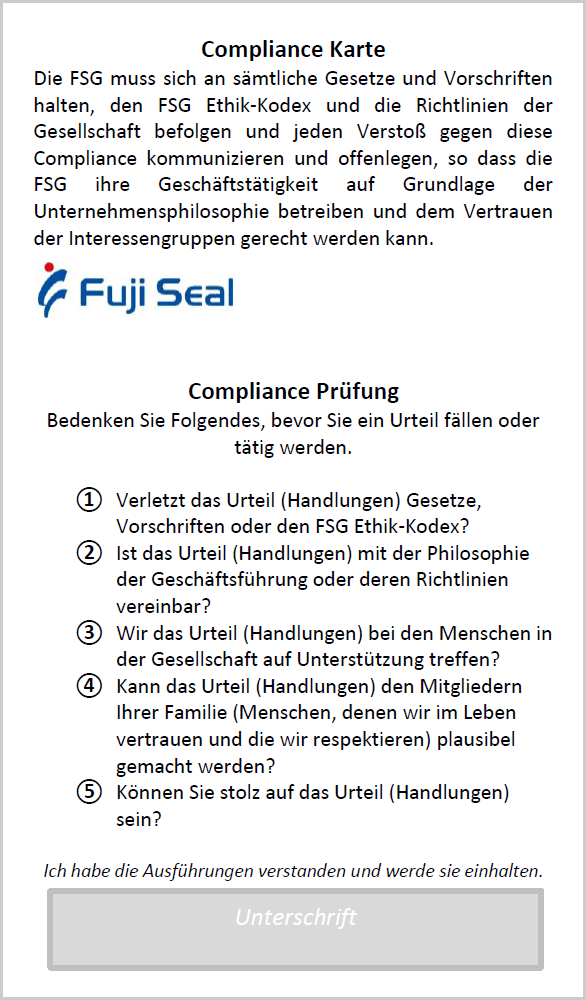

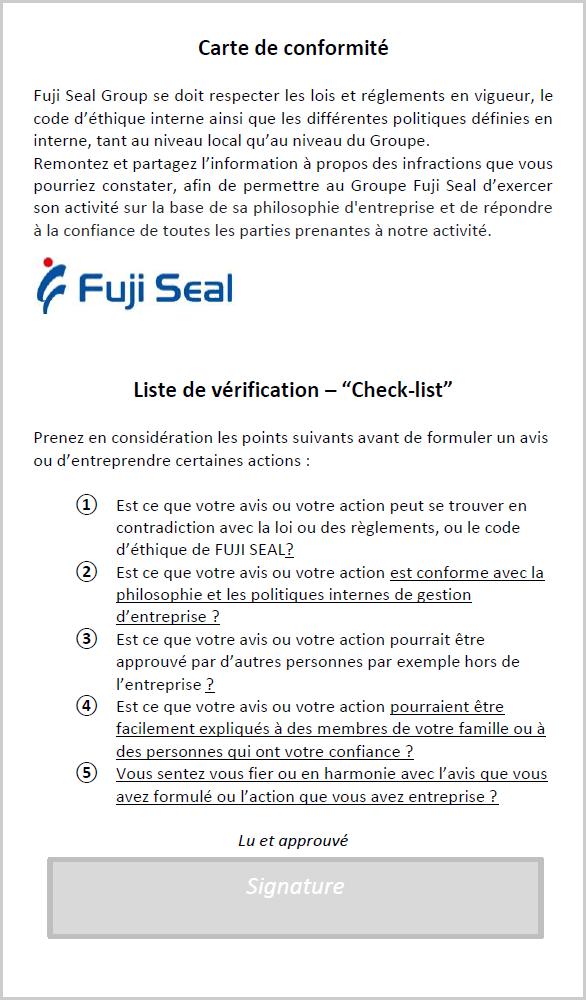

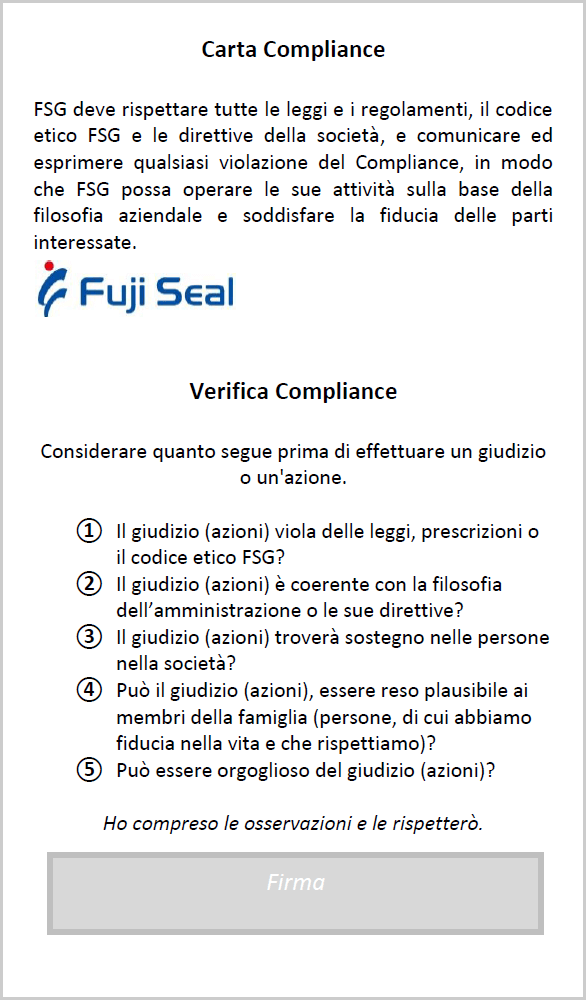

To spread the values aimed at in the FSG Code of Ethics

FSG distributes Compliance Cards to all Group executives and employees for educational purposes. In FY2024, we created a video summary of the FSG Code of Ethics in the 11 languages of the countries where FSG companies are located and integrated it with our e-learning system. Additionally, we provided training to managers and other personnel on ethical conduct, diversity, equity, and inclusion (DE&I), harassment, and anti-bribery and corruption.

In addition to distributing Compliance Cards and holding training sessions and seminars, we engage in the following ongoing activities: raising awareness through Family Festivals and company anniversary celebrations, displaying awareness posters in workplaces, and publishing articles about compliance in our in-house newsletter.

Each year at the Family Festival, top management reminds employees of the phrase written on the Compliance Card: "Can you explain that judgment (action) of yours to your family (loved ones)?" This phrase means that the Company believes it is important to continue a style of open management that can be explained to one's family and supported by one's family.

Consultation Hotline

To detect injustices, such as human rights infringements and harassment, as well as bribery and other compliance-related problems as early as possible and respond appropriately and promptly to them, we have in place a whistleblowing system (Consultation Hotline), which allows employees to report suspected cases directly to their company. Under this system, consultation requests and reports are accepted not only by the relevant in-house departments (including the Group Internal Audit Office) but also by external law offices and specialist companies.

The Consultation Hotline operates while ensuring complete confidentiality and preventing any disadvantageous treatment of whistleblowers. The system can be used anonymously. The status of acceptance of whistleblowing reports is regularly reported to the Group Compliance Committee, the Board of Directors, and the Audit Committee to improve Group compliance and risk management. In FY2024, we surveyed the operational status and actual implementation of whistleblowing systems in each region and reported and deliberated on the results at meetings of the Group Compliance Committee.

In order to quickly detect and understand issues that arise within the Group and take appropriate responses in a timely manner, we will continue to enhance our whistleblowing system and ensure its effectiveness.

Compliance Card

Compliance posters used in Europe

Family Festival and Foundation Day

The Company believes that the philosophy of corporate governance must penetrate not only the management team but also each employee. Awareness-raising activities are held by making the most of every possible opportunity so that employees will be able to understand the mission statement and the basic policy, and take appropriate action.

One example of such activities is the "Family Festival," which the Fuji Seal Group holds on the anniversary of the Company's foundation at each business location in Japan and the "Foundation Day Celebrations" abroad by inviting employees and their families.

This Family Festival dates back to 1985, when a festival was held concurrently with the establishment of the "Fuji Seal Employees Shareholding Association."

This festival serves as an opportunity for the employees' families to know and understand the Company's philosophy, history, products, workplaces and colleagues, not just to deepen friendships.Furthermore, the Compliance Card that employees always carry contains this phrase: "Can you explain that judgment (action) of yours to your family (loved ones)?" This phrase means that the Company believes it is important to continue a style of open management that can be explained to one's family and supported by one's family.

Family Festival and Foundation Day